Travel Insurance Market Analysis & Forecast 2025-2031

Travel Insurance Market by Insurance Type (Single Trip, Annual Multi-trip, and Long Stay) by End User (Senior Citizens, Education Travelers, Backpackers, Business Travelers, and Family Travelers) by Industry Analysis, Volume, Share, Growth, Challenges, Trends and Forecast 2025-2031, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa)

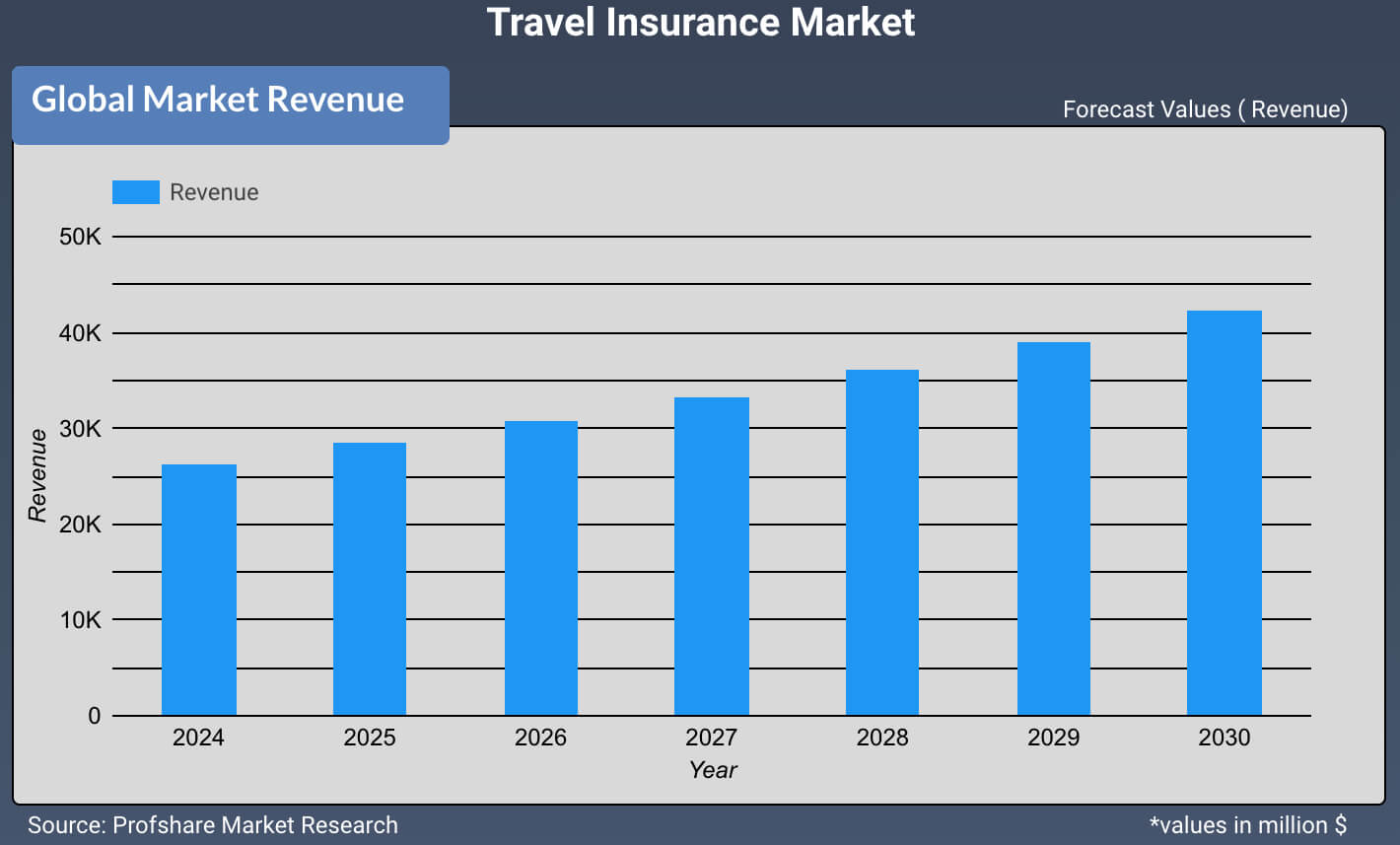

Global Travel Insurance Market is expected to reach USD 42344.35 million by 2032 with CAGR of 8.2 % between 2026 and 2032

Travel insurance is designed to provide financial protection for unexpected events during travelling. Travel insurance is an affordable way of protection for those travelling domestically or abroad. Travel insurance coverage include trip cancellation or interruption coverage, trip expenses, baggage and personal effects coverage, medical expense coverage, and accidental death or flight accident coverage. Travel insurance also provides emergency services like replacing lost passports, cash wire assistance, and re-booking cancelled flights. Travel insurance is frequently sold as a package that may include several types of coverage.

Single trip travel insurance covers travellers for one trip while annual travel insurance is designed to cover travellers taking multiple short trips throughout a year and long-stay travel insurance cover travellers who are spending an extended period away from home in one fell swoop. Single-trip travel insurance policy dominates the global market with 71% market share in 2023. Insurance intermediaries, insurance companies, banks, insurance brokers and insurance aggregators are primarily sold travel insurance policies. Insurance aggregators are expected to dominate the market during forecast period with a CAGR of 11.4% due to increasing usage of internet worldwide.

Travel insurance market is segmented into senior citizens, education travellers, backpackers, business travellers, and family travellers on end-user basis. Family travellers dominate the market while business travellers is fastest growing segment with CAGR of 9.4% during the forecast period, due to increased international trade, overseas business expansion, and increase in business travel expenditure. Growth in tourism is a major factor driving growth of the global travel insurance market. Worldwide growing terrorist attacks is further boosting demand for travel insurance in the global market.

Europe is the largest travel insurance market followed by Asia Pacific. Asia Pacific is expected to show highest growth rate during the forecast period due to a rise in the number of senior citizen travellers, and an increase in business travel expenditure. Travel industry is increasing as travel has become an accepted part of academic, business and personal life in the modern world. To minimize the risk associated with growing tourist traffic, increased incidences of loss of luggage, important documents, medical emergencies and natural calamities more travellers are adopting travel insurance. This is the major factor boosting growth of this market.

Global Travel Insurance Market : Insurance Type

- Single Trip

- Annual Multi-trip

- Long Stay

Global Travel Insurance Market: Application

- Senior Citizens

- Education Travellers

- Backpackers

- Business Travelers

- Family Travelers

Global Travel Insurance Market :Competitive Analysis

Report includes accurate analysis of key players with Market Value, Company profile, SWOT analysis. The Study consists of following key players in Global Travel Insurance Market :

- Berkshire Hathaway Specialty Insurance

- Travel Insured International

- Tokio Marine HCC Medical Insurance Services Group

- AIG Travel

- CSA Travel Protection

- Seven Corners Inc.

- Travel Safe

- Allianz Global Assistance

- AXA SA

- InsureandGo.

- Travelex Group

- USI Affinity

- MH Ross

- Travel Insured International

- Aviva PLC

- American Express Company

Geographical analysis of Travel Insurance Market:

-

North America

- U.S.A

- Canada

- Europe

- France

- Germany

- Spain

- UK

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South East Asia

- Latin America

- Brazil

- Middle East and Africa

Global Travel Insurance Market Report delivers a comprehensive analysis of the following parameters:

- Market Forecast for 2025-2031

- Market growth drivers

- Challenges and Opportunities

- Emerging and Current market trends

- Market player Capacity, Production, Revenue (Value)

- Supply (Production), Consumption, Export, Import analysis

- End user/application Analysis

Report Coverage

| Parameters | Details |

|---|---|

Base Year |

2025 |

Historical Data |

2019-2024 |

Forecast Data |

2025-2031 |

Base Year Value (2024) |

USD 24389.6 million |

Forecast Value (2031) |

USD 42344.35 million |

CAGR (2025-2031) |

8.2 % |

Regional Scope |

North America, Europe, Asian Pacific, Latin America, Middle East and Africa, and ROW |

Frequently Asked Questions (FAQ)

Travel Insurance Market was valued at around USD 24389.6 million in 2024 & is estimated to reach USD 42344.35 million by 2031.

Travel Insurance Market is likely to grow at Compound Annual Growth Rate (CAGR) of 8.2% between 2025-2031.

Travel Insurance Market is dominated by the Single Trip segment and the Europe region holds the highest market share in 2023.

Some of the top key players in the Travel Insurance Market are Berkshire Hathaway Specialty Insurance, Travel Insured International, Tokio Marine HCC Medical Insurance Services Group, AIG Travel, CSA Travel Protection, Seven Corners Inc., Travel Safe, Allianz Global Assistance, AXA SA, InsureandGo., Travelex Group, USI Affinity, MH Ross, Travel Insured International, Aviva PLC.

Primary driving factors for the growth of the Travel Insurance Market include Minimize the risk associated with growing tourist traffic, increased incidences of loss of luggage, important documents, medical emergencies and natural calamities more travellers are adopting travel insurance.

Yes, the report includes Geopolitical impact on the market.

Trending Technology & Media Reports

Mobile Encryption Technology Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa) and Forecast 2025-2031

Plasma TVs Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook, Geopolitical Impact and Forecast 2025-2031

Electrical Cable Conduits Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa) and Forecast 2025-2031

Cyber Insurance Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa) and Forecast 2025-2031