Cyber Insurance Market Analysis & Forecast 2025-2031

Cyber Insurance Market by Service Type ( Insurance, Claim Service, Risk Consulting) by Application /End User( BFSI, Healthcare, Retail & Manufacturing, IT Services) by Industry Analysis, Volume, Share, Growth, Challenges, Trends and Forecast 2025-2031, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa)

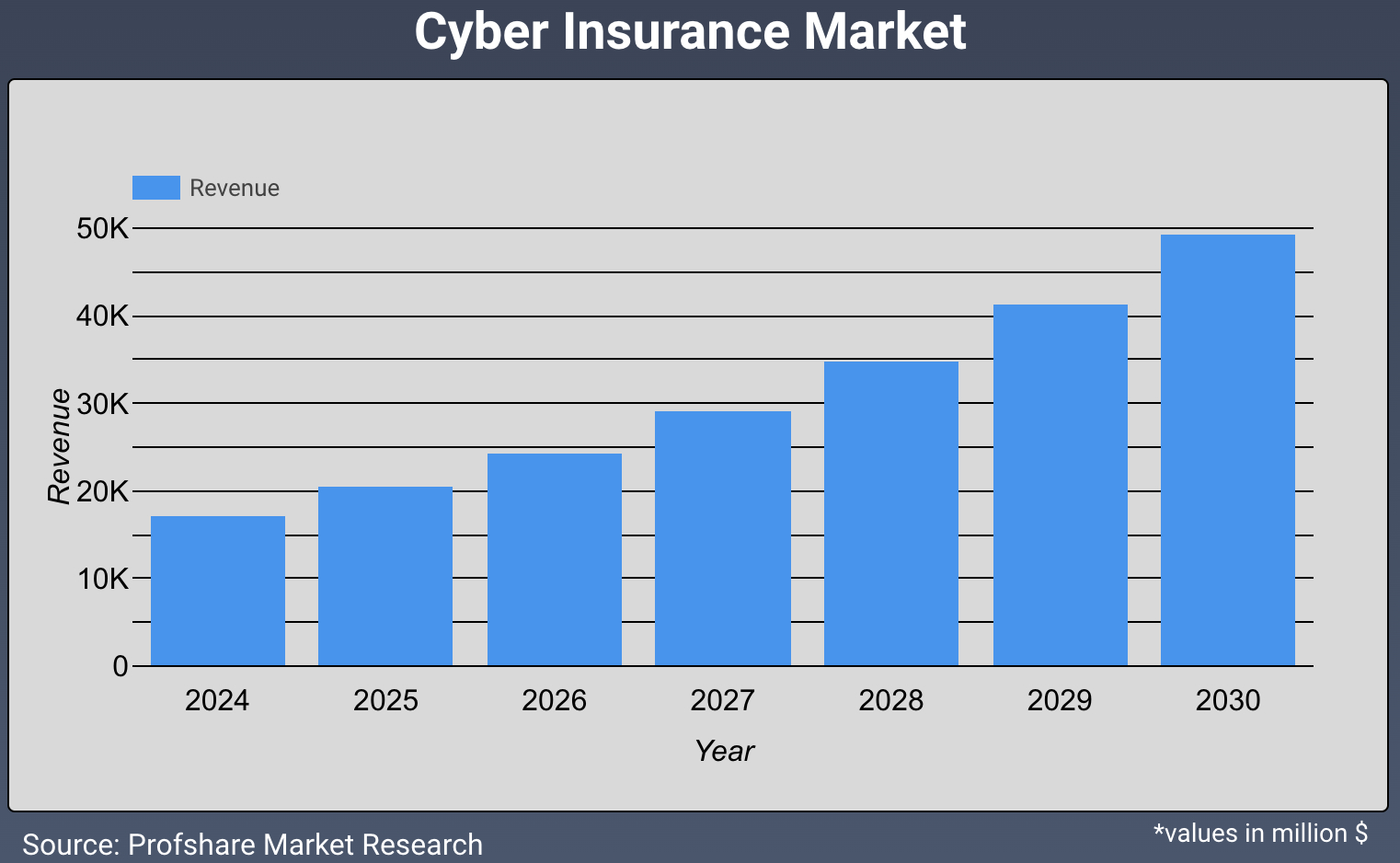

Global Cyber Insurance Market is expected to reach USD 49410.31 million by 2032 with CAGR of 19.2 % between 2026 and 2032

Cyber insurance market has emerged as data breaches are becoming way too common worldwide and the extent of damage that they cause to businesses. A data breach can damage companies’ reputation but also put its customers and/or employees at risk. Data breaches can have a huge influence on the company earnings. Hence cyber insurance can be a smart precaution for any size business. In 2023, more than 64% of global companies were insured against loss of income due to data breaches, while 35% of the companies without cyber liability insurance considered purchasing it.

The cyber insurance market is mainly driven by large enterprises as these enterprises have high purchasing power and the availability of sufficient funds for risk insurance. SME’s are not able to buy very high premiums for cyber insurance coverage due to their limited budget constraints over cyber risk management. Thus, the share of businesses with cyber insurance worldwide increased with company revenue. Only 4% of companies with revenues lower than USD 2.5 million owned cyber insurance while 26% of companies with revenues exceeding USD 5 billion owned cyber insurance.

In 2023 the United States is the largest cyber insurance market followed by Europe and Asia-Pacific. Cyber threats are increasing with growing digitization, interconnectivity, commercialization, and globalization. This has directly impacted the growth of the cyber insurance market.

Global Cyber Insurance Market : Product Types

- Stand-alone Cyber Insurance

- Packaged Cyber Insurance

Global Cyber Insurance Market : Applications

- BFSI

- Retail and Manufacturing

- Healthcare

- IT Services

Global Cyber Insurance Market : Company Analysis

- AIG

- Chubb

- XL Group

- Beazley

- Allianz

- Zurich Insurance

- Munich Re Group

Global Cyber Insurance Market : Regional Analysis

- North America

- U.S.A

- Canada

- Europe

- France

- Germany

- Spain

- UK

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South East Asia

- Latin America

- Brazil

- Middle East and Africa

Global Cyber Insurance Market Report delivers a comprehensive analysis of the following parameters:

- Market Forecast for 2025-2031

- Market growth drivers

- Challenges and Opportunities

- Emerging and Current market trends

- Market player Capacity, Production, Revenue (Value)

- Supply (Production), Consumption, Export, Import analysis

- End user/application Analysis

Report Coverage

| Parameters | Details |

|---|---|

Base Year |

2025 |

Historical Data |

2019-2024 |

Forecast Data |

2025-2031 |

Base Year Value (2024) |

USD 14450.53 million |

Forecast Value (2031) |

USD 49410.31 million |

CAGR (2025-2031) |

19.2 % |

Regional Scope |

North America, Europe, Asian Pacific, Latin America, Middle East and Africa, and ROW |

Frequently Asked Questions (FAQ)

Cyber Insurance Market was valued at around USD 14450.53 million in 2024 & is estimated to reach USD 49410.31 million by 2031.

Cyber Insurance Market is likely to grow at Compound Annual Growth Rate (CAGR) of 19.2% between 2025-2031.

Cyber Insurance Market Report is dominated by the BFSI segment and the North America region holds the highest market share in 2023.

Some of the top key players in the Cyber Insurance Market Report are AIG, Chubb, XL Group, Beazley, Allianz, Zurich Insurance, Munich Re Group.

Primary driving factors for the growth of the Cyber Insurance Market Report include Growing cyberattacks along with high purchasing power of the large organizations.

Yes, the report includes Geopolitical impact on the market.

Trending Technology & Media Reports

Travel Insurance Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa) and Forecast 2025-2031

Mobile Encryption Technology Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook, Geopolitical Impact and Forecast 2025-2031

Plasma TVs Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa) and Forecast 2025-2031

Electrical Cable Conduits Market Report Competitive Analysis, Revenue, Growth Strategies, Latest Trends, Regional Outlook ( North America, Europe, Asia-Pacific, Middle-East, Africa) and Forecast 2025-2031